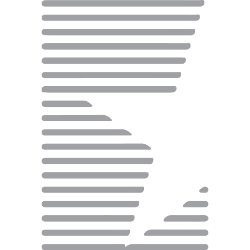

| 1 | NLY | Annaly Capital Management, Inc. | $22.98 | $14.73B | $1.70B | $1.50B | $2.27 | 5.93M |

| 2 | AGNC | AGNC Investment Corp. | $11.30 | $11.94B | $956.00M | $838.00M | $0.79 | 18.50M |

| 3 | STWD | Starwood Property Trust, Inc. | $18.08 | $6.52B | $1.42B | $366.27M | $1.02 | 2.71M |

| 4 | RITM | Rithm Capital Corp. | $10.60 | $5.99B | $3.88B | $649.55M | $1.15 | 6.72M |

| 5 | BXMT | Blackstone Mortgage Trust, Inc. | $19.66 | $3.36B | $507.96M | $107.20M | $0.62 | 1.07M |

| 6 | DX | Dynex Capital, Inc. | $13.97 | $2.20B | $397.53M | $319.06M | $2.03 | 5.72M |

| 7 | ARR | ARMOUR Residential REIT, Inc. | $17.78 | $1.86B | $73.06M | $64.54M | $0.62 | 3.95M |

| 8 | ABR | Arbor Realty Trust, Inc. | $7.33 | $1.54B | $441.68M | $183.71M | $0.87 | 5.83M |

| 9 | ARI | Apollo Commercial Real Estate Finance, Inc. | $10.68 | $1.48B | $274.20M | $138.17M | $0.99 | 1.02M |

| 10 | LADR | Ladder Capital Corp | $10.45 | $1.32B | $259.49M | $48.32M | $0.38 | 427.45K |

| 11 | EFC | Ellington Financial Inc. | $12.82 | $1.32B | $301.22M | $155.33M | $1.51 | 1.51M |

| 12 | TWO | Two Harbors Investment Corp. | $11.25 | $1.17B | $267.90M | -$454.30M | $-4.36 | 2.16M |

| 13 | PMT | PennyMac Mortgage Investment Trust | $12.51 | $1.09B | $260.82M | $122.05M | $1.40 | 772.20K |

| 14 | MFA | MFA Financial, Inc. | $9.92 | $1.05B | $337.45M | $128.37M | $1.21 | 1.20M |

| 15 | ORC | Orchid Island Capital, Inc. | $7.50 | $1.02B | $80.19M | $61.17M | $0.45 | 5.83M |

| 16 | CIM | Chimera Investment Corporation | $13.70 | $1.01B | $290.86M | $230.50M | $0.68 | 1.39M |

| 17 | RWT | Redwood Trust, Inc. | $6.49 | $837.33M | $407.26M | -$96.67M | $-0.75 | 2.32M |

| 18 | FBRT | Franklin BSP Realty Trust, Inc. | $8.88 | $804.53M | $432.78M | $95.09M | $1.05 | 2.01M |

| 19 | BRSP | BrightSpire Capital, Inc. | $5.80 | $753.10M | $321.11M | -$36.53M | $-0.28 | 788.29K |

| 20 | ADAM | Adamas Trust, Inc. | $8.11 | $742.99M | $227.83M | $64.13M | $0.70 | 567.66K |

| 21 | TRTX | TPG RE Finance Trust, Inc. | $8.81 | $694.35M | $150.66M | $67.03M | $0.85 | 848.09K |

| 22 | NREF | NexPoint Real Estate Finance, Inc. | $14.96 | $656.06M | $151.95M | $96.42M | $2.20 | 57.14K |

| 23 | IVR | Invesco Mortgage Capital Inc. | $8.69 | $589.60M | $72.30M | $53.29M | $0.79 | 2.05M |

| 24 | KREF | KKR Real Estate Finance Trust Inc. | $6.88 | $459.64M | $112.98M | -$47.05M | $-0.72 | 1.59M |

| 25 | CMTG | Claros Mortgage Trust, Inc. | $2.52 | $354.22M | $9.05M | -$370.56M | $-2.64 | 273.10K |

| 26 | RC | Ready Capital Corporation | $1.74 | $288.62M | $21.64M | -$310.87M | $-1.87 | 2.86M |

| 27 | ACRE | Ares Commercial Real Estate Corporation | $5.21 | $285.96M | $36.27M | -$902.00K | $-0.02 | 536.98K |

| 28 | MITT | TPG Mortgage Investment Trust, Inc. | $8.53 | $264.98M | $179.84M | $49.66M | $1.60 | 211.08K |

| 29 | REFI | Chicago Atlantic Real Estate Finance, Inc. | $11.88 | $255.25M | $55.22M | $35.77M | $1.67 | 145.03K |

| 30 | AOMR | Angel Oak Mortgage REIT, Inc. | $9.14 | $224.49M | $34.71M | $17.65M | $0.72 | 78.61K |

| 31 | ACR | ACRES Commercial Realty Corp. | $18.65 | $136.41M | $88.61M | $23.16M | $3.17 | 13.48K |

| 32 | SEVN | Seven Hills Realty Trust | $8.74 | $131.33M | $24.79M | $15.52M | $1.03 | 80.17K |

| 33 | SUNS | Sunrise Realty Trust, Inc. | $9.34 | $124.07M | $22.82M | $12.37M | $0.93 | 32.97K |

| 34 | RPT | Rithm Property Trust Inc. | $14.70 | $111.29M | $7.65M | $1.15M | $0.15 | 49.81K |

| 35 | CHMI | Cherry Hill Mortgage Investment Corporation | $2.58 | $93.26M | $30.29M | $16.14M | $0.45 | 185.15K |

| 36 | GPMT | Granite Point Mortgage Trust Inc. | $1.73 | $81.99M | $43.91M | -$56.18M | $-1.19 | 505.01K |

| 37 | LFT | Lument Finance Trust, Inc. | $1.31 | $68.58M | $24.61M | $9.80M | $0.19 | 104.37K |

| 38 | LOAN | Manhattan Bridge Capital, Inc. | $4.42 | $50.56M | $7.15M | $5.29M | $0.46 | 29.45K |

| 39 | AFCG | Advanced Flower Capital Inc. | $2.27 | $50.30M | $15.41M | -$22.58M | $-1.02 | 201.12K |

| 40 | SACH | Sachem Capital Corp. | $1.01 | $47.37M | $-9.66M | -$32.35M | $-0.69 | 107.39K |

| 41 | AGNCM | AGNC Investment Corp. | $25.04 | — | $956.00M | $838.00M | — | 9.43K |